field_text

field_text

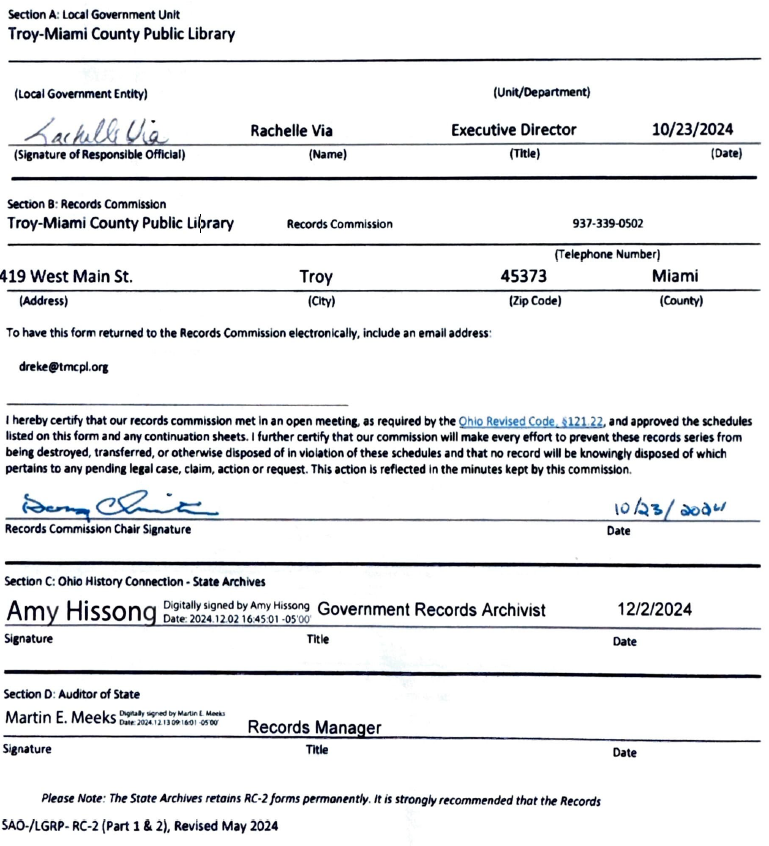

Records Retention Schedule (RC-2) - Part 1

See instructions before completing this form. Must be submitted with Part 2

field_text

Appendix A - Public Records & Retention Policy

Record Retention Schedule (RC-2) - Part 2 | |||||

|---|---|---|---|---|---|

| Troy Miami County Public Library | |||||

| Schedule Number | Record Title and Description | Retention Period | Media Type | For use by Auditor of State or OHS/LGRP | RC-3 Required by OHS/LGRP |

| Permanent | paper thru 2007, elec 2008 forward | ||||

| AD-001 | Board of Trustee Meeting Agendas & Minutes | Permanent | paper | ✓ | |

| AD-002 | Building Specifications and Plans | Permanent | paper | ✓ | |

| AD-003 | Historical Files - relating to growth of library | Permanent | paper | ||

| AD-004 | Annual report to state library | Permanent | paper | ✓ | |

| AD-005 | Annual Financial Report to Auditor of State | Permanent | paper | ✓ | |

| FN-006 | OPERS Reports | Permanent | paper | ||

| FN-007 | Audit Reports from Auditor of State | Permanent | paper | ||

| PA-009 | Payroll Tax Records | Permanent | paper/elec | ||

| PA-010 | W-2 Forms | Permanent | paper/elec | ||

| Non-Permanent | |||||

| AD-011 | Staff Meeting Minutes | Current year | paper/elec | ||

| AD-012 | Audio of board meeting | 1 year | electronic | ||

| AD-013 | Contracts, Leases and Agreements | 5 years after expiration | paper | ||

| AD-014 | Transient correspondence material (all informal and/or temporary messages and notes, including e-mail and voice mail messages, and all drafts used in the production of public records) | Discretionary, retain until no longer of administrative value | paper/elec | ||

| AD-015 | Levy Files; official documents | Life of levy plus 5 years | paper | ||

| AD-016 | Public Record Requests | Until audited | paper/elec | ||

| AD-017 | Construction and renovation bids and documents including bid advertisements, bid documents, specifications, successful bids, contracts | As long as the constructed or renovated facility is owned or leased. | paper/elec | ||

| AD-018 | Bids - Successful - documents and specifications pertaining to successful bids for general purpose contracts excluding construction contracts | 5 years after expiration or completion of project | paper | ||

| AD-019 | Bids - Unsuccessful | 4 years after setting of contract, if audited | paper | ||

| AD-020 | RFPs and Proposals in response | 2 years, if audited | paper | ||

| AD-021 | Administrative Policy & Procedure Files | 1 year after superseded | electronic | ||

| AD-022 | Book Inventories maintained digitally | Until superseded | electronic | ||

| AD-023 | Transient correspondence material (all informal and/or temporary messages and notes, including e-mail and voice mail messages, and all drafts used in the production of public records) | Discretionary, retain until no longer of administrative value | paper/elec | ||

| AD-024 | Program Registrations & Releases - registrations, releases, waivers, sign-ups, permission slips, applications, and any other documentation patrons are required to fill out in order to participate in a Library program. | Until no longer of administrative value | paper | ||

| AD-025 | Patron Information; maintained digitally | 6 years after inactive if no outstanding fees or credits | electronic | ||

| AD-025.1 | Security Camera Videos | 48 hours | electronic | ||

| FN-026 | Annual Budgets - adopted by the board | 10 years | paper/elec | ||

| FN-027 | Purchase Orders | 2 years, if audited | paper | ||

| FN-028 | Bank Deposit Receipts | Until audited | paper | ||

| FN-029 | Bank Statements | 4 years, if audited | paper | ||

| FN-030 | Receipt Records | Until audited | paper | ||

| FN-031 | Gift/Donation records | 5 years, if audited | paper/UAN | ||

| FN-032 | Endowment and major gift records | As long as gift is held plus 10 years | paper | ||

| FN-033 | Prevailing Wages Records | 4 years, if audited | electronic | ||

| FN-034 | Depository Agreements | 4 years, if audited | paper | ||

| FN-035 | Cash Register Tapes | Until audited | paper | ||

| FN-036 | Official Certificate of Estimated Resources (from County Auditor's office) | 5 years, if audited | paper | ||

| FN-037 | Certificate of Total Amount from All Sources | 5 years, if audited | paper | ||

| FN-038 | Amended Certificate of Total Amount from All Sources Available for Expenditure and Balances (from County Auditor's Office) | 5 years, if audited | paper | ||

| FN-039 | Insurance Policies; includes property, liability | 12 years after expiration if claims are settled | paper | ||

| FN-040 | Certificates of Liability Insurance | Time in force plus 4 years | paper | ||

| FN-041 | Fixed Asset Inventory | 5 years after superseded | paper | ||

| FN-042 | Voucher w/ Invoices | 5 years, if audited | paper/elec | ||

| FN-043 | Employer Quarterly Federal Tax Returns | 5 years, if audited | paper/elec | ||

| FN-044 | Quarterly Payroll Reports for State | 75 years | paper/elec | ||

| FN-045 | Investment Reports | 4 years, if audted | paper/elec | ||

| FN-046 | Records Commission/ Records Disposal | 10 years | paper/elec | ||

| FN-047 | Cancelled Checks | 2 years | elec/bank | ||

| HR-048 | Personnel Files - Official personnel file on each employee includes information on hiring, promotion, demotion, transfer, layoff, recall, performance evaluations, rates of pay, state & federal tax forms, deduction authorizations, and separation information | 6 years after termination of employment | paper | ||

| HR-049 | Employment Application | retain with personnel record if employed, others 1 year | paper/elec | ||

| HR-050 | Immigration Forms - I-9 forms | Later of 3 yrs after DOH or 1 yr after DOT | paper | ||

| HR-051 | Employee Handbook/Policies | 1 year after superseded | electronic | ||

| HR-052 | Accident/Incident Reports | 5 years provided no pending action | paper/elec | ||

| HR-053 | PERRP Forms 300P & 300A; record of recordable injuries/illness | 5 years | paper/elec | ||

| HR-054 | Workers Comp Claims | 10 years after date of final payment | paper/elec | ||

| HR-055 | Unemployment Claim Reports | 4 years, if audited | paper | ||

| HR-056 | Job Descriptions | Until superseded | electronic | ||

| PA-008 | Payroll Records; includes EFT Bank Rcpts, Reports & Advices | 7 years | paper/elec/UAN | ||

| PA-057 | Timesheets | 4 years, if audited | paper | ||

| PA-058 | Deferred Compensations Withholding Rpts and Payment Receipts | 4 years, if audited | paper/UAN | ||

NOTE: Retention periods based on applicable laws and/or recommendations from the Auditor of State's Office and the Ohio Historical Society as published In the OLC Public Library Accounting Handbook

Audited means: the years encompassed by the records have been audited by the Auditor of State and the audit report has been released pursuant to Sec. 117.26 O.R.C